25 Nov, 2025

1H26: Record TTV, Revenue & EBITDA.

Web Travel Group (WEB Travel Group Limited, ASX:WEB) today announced its financial results for the 6 months to 30 September 2025.

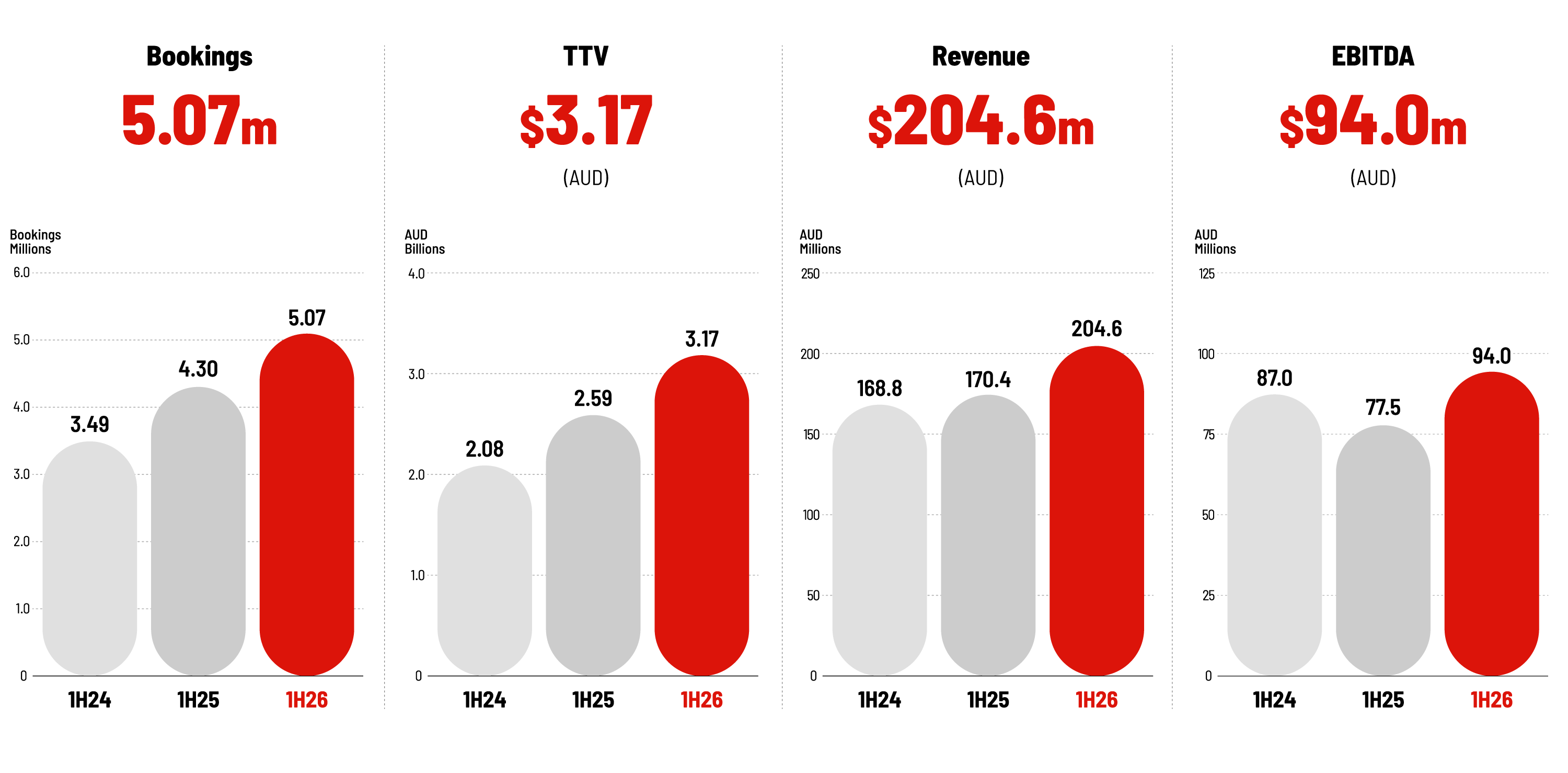

Web Travel Group’s results for the 1H25 period saw Bookings, Total Transaction Value (TTV), Revenue, and earnings before interest, tax, depreciation and amortisation (EBITDA) all up significantly compared to the same period last year.

The Company’s results reflect the performance of the WebBeds business.

(Additional information can be found in the ASX Release and Managing Director's Presentation.)

WebBeds Bookings were up 18% driven by growth in all regions, most notably the Americas. TTV was up 22% in line with Bookings growth and channel and geographic mix. Revenue was up 20% reflecting margin stabilisation. 1H26 TTV margins were above guidance1 at 6.5% and reflect the sale of the DMC business that accounted for circa 0.2% of 1H25 TTV margin. Expenses were up 19% reflecting CPI increases and the re-inclusion of bonuses during the period, as well as planned investment in hotel contracting resources. WebBeds EBITDA was up 21% reflecting Revenue growth and planned increase in Operating Expenses. WebBeds EBITDA margin was 45.9%. Underlying Group EBITDA was up 17% after taking into account corporate overheads.

Commenting on the result, WEB Travel Group’s Managing Director John Guscic said:

“WebBeds continues to deliver world class TTV growth. We reported $3.2 billion TTV for the first 6 months of the financial year, 22% more than the same period last year, driven by the significant above-market growth coming through in our top 3 regions, particularly the Americas. A range of initiatives have helped optimise TTV margins which were 6.5% for the period, ahead of our guidance . TTV margins remain on track to be at least 6.5% for FY26.

This impressive growth is a reflection of our efforts and not macro-economic events. We delivered an incremental $580 million TTV compared to the same period last year, with improved TTV margins. WebBeds continues to win global share, which is amplifying the network effect and making us even more relevant to our hotel supply and travel buyer partners. The team’s unwavering focus on winning new clients, enhancing supply and geographic reach, and continuing to improve conversions is bringing us closer to our $10 billion TTV FY30 target.

We continue to build out our leading global marketplace to deliver profitable growth. WebBeds is a highly scalable business. We are maintaining market leading TTV growth rates without any margin decline and the investment we have made in contracting staff is expected to have meaningful impact to results in FY27.

Trading for the first 7 weeks of 2H26 has been strong with TTV up 23% compared to the same period last year. We are on track to deliver record results with FY26 underlying EBITDA expected to be between $147 and $155 million.”

You can find all related documents on the ASX Releases page of our Investor Centre website, with some key documents and commentary below.

1H26 - Investor Briefing - Webcast Recording

25 Nov, 2025

1H26 - Managing Director's Presentation

25 Nov, 2025

1H26 - ASX Release - Results Announcement

25 Nov, 2025

1H26 - Half Year Report & Appendix 4D

25 Nov, 2025

Further information on 1H26 performance is set out in Web Travel Group’s 1H26 Investor Briefing Presentation.

The Company will release FY26 results on 27 May 2026*. Visit our Investor Calendar page for briefing details closer to the event.

This announcement has been approved for release to the ASX by the Board of Directors.

For further information.

Investors.

Please contact Carolyn Mole at investor@webtravelgroup.com

The Web Travel Group is proud to support 40:40 Vision to achieve gender balance in senior leadership by 2030.

WebBeds partners with BeCause – a sustainability technology start-up transforming how companies in travel manage their sustainability data – to scale up the number of properties tagged as ‘eco-certified’ on WebBeds booking platforms.